| Additional Support | |||||||||||||

| Electric Vehicle Charging 101 | |||||||||||||

| Electric Vehicle Charging Time Calculator | |||||||||||||

Estimate the time it will take to charge an electric vehicle by entering the battery capacity and charge level along with the charging power. Electric Vehicle Charging Time Calculator |

|||||||||||||

| EV Charge Solutions® Trade-in Program | |||||||||||||

Seamlessly upgrade your setup by trading in your existing electric vehicle charging station

and a receiving a substantial discount towards the revolutionary EVBox IQON.

Our customer-centric approach is a simple process: just fill out the designated form detailing your current unit’s specifications.

A photo of the trade-in unit is required along with this form to qualify. Submit these documents to Sales@evCHARGEsolutions.com, and you’re on your way to the future of EV charging!

• Single Unit defined as (1) Single Port Unit • Dual Unit defined as (1) Dual Port Unit or (2) Single Port Units • Eligibility / Requirements: A maximum of 10 ports per location my be traded-in, trade-in units must be destroyed & properly disposed, any Level 2 EV charging station qualifies, operable or not. • A clear photo of the trade-in unit must be provided in order to qualify for this program. • Terms: Limited IQON chargers allocated to program, program ends when allocated chargers are gone, new IQON must be networked, EVCS may end program at any time, IQON chargers come with a 3-year (parts only) warranty DOWNLOAD THE FORM (Click image below to download the fillable EV Charge Solutions® Trade-in Program Form.) Upon completion, please send to: Sales@evCHARGEsolutions.com and be sure to attach your trade-in unit photo! If you have further questions or need assistance, we're available to help! Call us at (585) 533-4051 to get a LIVE representative.

|

|||||||||||||

| State Funding, Grants & Incentives: Delaware | |||||||||||||

PECO provides rebates of $50 to residential customers who purchase a new, qualified PEV. Delaware Clean Transportation Incentive Program, from the Delaware Department of Natural Resources and Environmental Control, offers rebates for new Level 2 EVSE purchased for use at commercial and residential locations. Rebate amounts are 50% of the cost of a residential charging station (up to $500) and 75% of the cost of a commercial or workplace charging station (up to $2,500 per port). Delaware Code Retail electricity customers with at least one grid-integrated electric vehicle (EV) may qualify to receive kilowatt-hour credits for energy discharged to the grid from the EV's battery at the same rate that the customer pays to charge the battery. |

|||||||||||||

| State Funding, Grants & Incentives: Wyoming | |||||||||||||

|

|||||||||||||

| State Funding, Tax Credits, & Rebates: Arizona | |||||||||||||

SRP offers an experimental time-of-use (TOU) electricity rate for the first 10,000 customers with a qualified PEV. The TOU rate is for the super off-peak hours between 11pm and 5am daily. Participation is subject to certain equipment availability and other restrictions. For more information, see the SRP Electric Vehicle Price Plan website.

TEP offers a discounted residential service time-of-use (TOU) rate during off-peak periods to customers who own and operate a PEV. The discount is a 5% reduction to applicable charges during the off-peak period. Eligible customers must provide documentation for a highway-approved PEV and submit a copy of the PEV's registration annually. For more information, including the application, see the

TEP TOU website.

|

|||||||||||||

| State Funding, Tax Credits, & Rebates: California | |||||||||||||

The Southern California Edison (SCE) Clean Fuels Rewards program offers a $1000 rebate for driving a new, used, or leased electric vehicle (battery electric or plug-in hybrid). This offering is only available to SCE customers with an active residential electricity account. If you have multiple eligible EVs in your household, you may receive a rebate for each vehicle if you otherwise qualify. Redding Electric Utility (REU) is offering a $1,000 account credit for the purchase or lease of a new qualified electric vehicle (up to 2). See the REU Residential EV Rebate Application for complete list of terms and conditions. REU is also offering $1,000 for the purchase or lease of a new qualified electric vehicle (up to 10). The San Joaquin Valley Air Pollution Control District Drive Clean Rebate offers a rebate to local residents and businesses for purchasing EVs. The rebate is up to $3,000 for zero emission vehicles and up to $2,000 for plug-in hybrids. The local rebate can also be combined with state and federal rebates. The Northern Sonoma County Air Pollution Control District (NSCAPCD) offers a rebate program for the purchase or lease of an eligible clean vehicle. Rebates include $3,000 for battery electric and $2,000 for plug-in hybrid. The District territory includes the northern and coastal regions of Sonoma County, including Healdsburg, Cloverdale, and Guerneville. The Monterey Bay Air Resources District (MBARD) is offering a rebate for electric vehicles for residents of Monterey, San Benito, and Santa Cruz Counties. Applicants must purchase or lease an eligible new vehicle before applying for a rebate. MBARD is providing $2,000 rebates for new battery electric vehicles, $1,000 for new plug-in hybrid electric vehicles, $500 for new electric motorcycles, $1,000 for used battery electric vehicles, and $500 for used plug-in hybrid electric vehicles. Rebates will be issued starting July 1, 2017. This program is first-come, first-served and rebates are issued pending on availability of funds. California Electric Vehicle Infrastructure Project (CALeVIP) Central Coast Incentive Project In partnership with Monterey Bay Community Power, this new regional project offers an opportunity for businesses, nonprofits, government entities, and others in Monterey, San Benito, and Santa Cruz counties to apply for rebates on EV charging equipment that cover eligible purchase and installation costs.

Marin Clean Energy (MCE) Charging Station Program offers rebates for Level 2 EVSE for workplaces and multifamily properties (market rate and low income with four or more units) of up to $2,500 per port. Farmers Insurance provides a discount of up to 10% on all major insurance coverage for HEV and AFV owners. The Eastern Kern Air Pollution Control District’s 2020 DMV Grant Voucher Program offers financial incentive in the form of a voucher for the purchase of a new eligible lower-emitting vehicle. Applications are processed first-come first-served and vouchers issued accordingly until funds are exhausted. Voucher awards and associated new vehicle emission classification requirements are as follows:

•

$4,000 for purchase of a Zero Emission Vehicle (ZEV) with EPA Smog Score of 10.

•

$2,000 for purchase of a Partial Zero Emission Vehicle (PZEV) with EPA Smog Score of 8 or 9.

•

$1,000 for purchase of a Super Ultra Low Emission Vehicle (SULEV) with EPA Smog Score of 6 or 7.

Electric Vehicle Supply Equipment (EVSE) Loan and Rebate Program The Electric Vehicle Charging Station Financing Program, part of the California Capital Access Program (CalCAP), provides loans for the design, development, purchase, and installation of EVSE at small business locations in California. The Program may provide up to 100% coverage to lenders on certain loan defaults. Lenders must apply to the California Pollution Control Financing Authority (CPCFA) to participate and enroll each qualified EVSE loan through CalCAP. Upon approval, CPCFA will pay a premium into the lender's loan loss reserve account for up to 20% of the loan amount and contribute an additional 10% for installations in multi-unit dwellings and disadvantaged communities. Small businesses are eligible for a rebate of 50% of the loan loss reserve amount after the small business repays the loan in full or meets monthly payment deadlines over a 48-month period. Eligible borrowers must be small businesses with 1,000 or fewer employees and must maintain legal control of the EVSE for the entire loan period. The maximum loan amount is $500,000 per qualified small business and can be insured for up to four years. The California Energy Commission funds the Program. For more information, including EVSE technical requirements and eligibility requirements for both borrowers and lenders, see the Program website. Plug-In Hybrid and Zero Emission Light-Duty Vehicle Rebates The Clean Vehicle Rebate Project (CVRP) offers rebates for the purchase or lease of qualified vehicles. Qualified vehicles are light-duty zero emission vehicles and plug-in hybrid electric vehicles (PHEVs) the California Air Resources Board (ARB) has approved or certified. The rebates are for up to $5,000 for fuel cell electric vehicles (FCEVs), $2,500 for battery electric vehicles, $1,500 for PHEVs, and $900 for zero emission motorcycles. Rebates are available on a first-come, first-served basis to individuals, business owners, and government entities in California that purchase or lease new eligible vehicles. Residents of San Diego County may be eligible for a preapproved rebate through the CVRP Rebate Now pilot. Manufacturers must apply to ARB to have their vehicles included in the CVRP. Individuals are eligible for the rebate based on gross annual income, as stated on the individual's federal tax return. Individuals with a gross annual income above the following thresholds are only eligible for rebates for FCEVs: $150,000 for single filers $204,000 for head-of-household filers $300,000 for joint filers For individuals with low and moderate household incomes of less than or equal to 300% of the federal poverty level, rebates are increased by $2,000, for a total rebate amount of up to $7,000. Increased rebates are available for ARB-approved FCEVs, PHEVs, and battery electric vehicles. ARB must provide outreach to low income households and communities to raise awareness about CVRP. Through January 1, 2022, ARB must prioritize rebate payments for low income applicants. Alternative Fuel and Advanced Vehicle Rebate - San Joaquin Valley The San Joaquin Valley Air Pollution Control District (SJVAPCD) administers the Drive Clean! Rebate Program, which provides rebates for the purchase or lease of eligible new vehicles, including qualified natural gas, hydrogen fuel cell, propane, battery electric, neighborhood electric, and plug-in electric vehicles, and zero emission motorcycles. The program offers rebates of up to $3,000, which are available on a first-come, first-served basis for residents and businesses located in the SJVAPCD. For more information, including a list of eligible vehicles and other requirements, see the SJVAPCD Drive Clean! Rebate Program website. Electric Vehicle Supply Equipment (EVSE) Loan and Rebate Program The Electric Vehicle Charging Station Financing Program (Program), part of the California Capital Access Program (CalCAP), provides loans for the design, development, purchase, and installation of EVSE at small business locations in California. The Program may provide up to 100% coverage to lenders on certain loan defaults. Lenders must apply to the California Pollution Control Financing Authority (CPCFA) to participate and enroll each qualified EVSE loan through CalCAP. Upon approval, CPCFA will pay a premium into the lender's loan loss reserve account for up to 20% of the loan amount and contribute an additional 10% for installations in multi-unit dwellings and disadvantaged communities. Small businesses are eligible for a rebate of 50% of the loan loss reserve amount after the small business repays the loan in full or meets monthly payment deadlines over a 48-month period. Eligible borrowers must be small businesses with 1,000 or fewer employees and must maintain legal control of the EVSE for the entire loan period. The maximum loan amount is $500,000 per qualified small business and can be insured for up to four years. The California Energy Commission funds the Program. For more information, including EVSE technical requirements and eligibility requirements for both borrowers and lenders, see the Program website. Alternative Fuel Vehicle (AFV) Rebate - Antelope Valley The Antelope Valley Air Quality Management District’s (AVAQMD) AFV Program offers rebates of up to $1,000 to residents toward the purchase or lease of a new AFV. Qualifying technologies include, but are not limited to, all-electric, plug-in hybrid electric, and compressed natural gas. AFVs purchased or leased outside of the AVAQMD jurisdiction are eligible for half of the rebate amount. For more information, including how to apply, see the AVAQMD AFV Program website. Clean Vehicle Rebate - El Dorado County The El Dorado County Air Quality Management District (AQMD) offers rebates of up to $1,000 to residents toward the purchase or lease of a new zero emission vehicle or partial zero emission vehicle, as defined by the California Air Resources Board. To qualify, vehicles must be owned or leased for at least three years within El Dorado County. For more information, see the AQMD Grants and Incentives website. Plug-In Electric Vehicle (PEV) Charging Rate Reduction - SMUD The Sacramento Municipal Utility District (SMUD) offers a discounted rate to residential customers for electricity used to charge PEVs. For more information, see the SMUD Time-of-Day Rate website. Alternative Fuel Vehicle (AFV) and Hybrid Electric Vehicle (HEV) Insurance Discount Farmers Insurance provides a discount of up to 10% on all major insurance coverage for HEV and AFV owners. To qualify, the automobile must be a dedicated AFV using ethanol, compressed natural gas, propane, or electricity, or be a HEV. A complete vehicle identification number is required to validate vehicle eligibility. For more information, see the Farmers Insurance California Insurance Discounts website. Plug-In Electric Vehicle (PEV) Charging Rate Reduction - LADWP The Los Angeles Department of Water and Power (LADWP) offers a $0.025 per kilowatt-hour discount for electricity used to charge PEVs during off-peak times. Residential customers who install a separate time-of-use meter panel will also receive a $250 credit. For more information, see the LADWP Electric Vehicle Incentives website. Plug-In Electric Vehicle (PEV) Charging Rate Reduction - SCE Southern California Edison (SCE) offers a discounted rate to customers for electricity used to charge PEVs. Two rate schedules are available for PEV charging during on- and off-peak hours. For more information, see the SCE Electric Vehicle Residential Rates website. Clean Vehicle Electricity and Natural Gas Rate Reduction - PG&E Pacific Gas & Electric (PG&E) offers discounted residential time-of-use rates for electricity used for plug-in electric vehicle charging. Discounted rates are also available for compressed or uncompressed natural gas used in natural gas vehicle (NGV) home fueling appliances. For more information, see the PG&E Electric Vehicle Rate Plans and NGV Rates websites. Plug-In Electric Vehicle (PEV) and Natural Gas Infrastructure Charging Rate Reduction - SDG&E San Diego Gas & Electric (SDG&E) offers lower rates to customers for electricity used to charge PEVs. SDG&E's EV Time-of-Use rates are available in three variations: EV-TOU-2 and EV-TOU-5 bill home and vehicle electricity use on a single meter; and EV-TOU bills vehicle electricity use separately, requiring the installation of a second meter. Lower rates are also available to customers who own a natural gas vehicle (NGV) and use a qualified compressed natural gas fueling appliance at home. For more information about EV Time-of-Use rates, see the SDG&E EV Pricing Plans and NGV Rates website. Electric Vehicle Supply Equipment (EVSE) Rebate - LADWP The Los Angeles Department of Water and Power (LADWP) provides rebates to commercial and residential customers toward the purchase of Level 2 EVSE. Commercial customers who purchase and install EVSE for employee and public use can receive up to $5,000 for each charger, with up to $750 in additional rebate funds per extra charge port. Rebates do not cover the cost of installation. Eligible customers may qualify for up to 40 rebate awards depending on the number of parking spaces at the installation site. Residential customers who install wall-mounted chargers can receive up to $500. EVSE must be installed within the LADWP service area. Rebates are available on a first-come, first-served basis through June 30, 2021, or until funds are exhausted. For program guidelines and application materials, see the Charge Up L.A.! website. Electric Vehicle Supply Equipment (EVSE) and Charging Incentives - Sonoma Clean Power Qualified Sonoma Clean Power (SCP) customers are eligible to receive a free EVSE that can be connected to Wi-Fi and communicate with the SCP GridSavvy Community. Customers are responsible for shipping and installation costs. Customers may also receive $5 per month for connecting the EVSE to the GridSavvy Community. Other terms and conditions may apply. For more information, including frequently asked questions, see SCP's GridSavvy website. Plug-In Electric Vehicle (PEV) Rebate - PG&E Pacific Gas and Electric (PG&E) provides rebates of $500 to residential customers who purchase or lease an eligible PEV. Residential account holders may apply on behalf of a PEV owner in their household or their tenant in a multifamily household with the vehicle owner's permission. For more information, see the PG&E Clean Fuel Rebate website. Residential Electric Vehicle Supply Equipment (EVSE) Incentives - SMUD Sacramento Municipal Utility District (SMUD) offers residential customers a $599 rebate or a free Level 2 (240 volt) EVSE. Rebates or chargers are available to SMUD residential customers with the purchase or lease of a new plug-in electric vehicle (PEV). To be eligible for the rebate or charger, completed applications must be postmarked within 180 days of the date of purchase or lease of the PEV. Additional terms and conditions apply. For more information, including the rebate application, please see SMUD's Drive Electric Incentive website. Plug-In Electric Vehicle (PEV) Credit - SDG&E San Diego Gas & Electric (SDG&E) offers an annual credit ranging from $50 to $500 to customers who own or lease a PEV. The credit is available to qualified customers through 2019. For more information, including how to apply, see the SDG&E Electric Vehicle Climate Credit website. Plug-In Electric Vehicle (PEV) Rebate - SCE Southern California Edison's (SCE) Clean Fuel Reward Program provides rebates of up to $1,000 to residential customers who purchase or lease an eligible new or used PEV. Residential account holders may apply on behalf of a PEV owner in their household. For more information, see the SCE Clean Fuel Reward Program website. Plug-In Electric Vehicle (PEV) Rebate - Pasadena Water and Power (PWP) PWP provides rebates of $250 to residential customers who purchase or lease an eligible new or used PEV. An additional $250 is available for eligible PEVs purchased or leased from a Pasadena dealership. Customers participating in PWP's income-qualifying programs may also qualify for an additional $250 rebate, for a total of $750. Rebates are available for PEVs purchased or leased on or after August 1, 2018. Additional terms and conditions apply. For more information, see the PWP Residential Electric Vehicle and Charger Incentive Program website. Plug-In Electric Vehicle (PEV) Charging Rate Reduction - Azusa Light & Water Azusa Light & Water offers a $0.05 per kilowatt-hour (kWh) discount for electricity used to charge PEVs during off peak times. Customers must use a minimum of 50 kWh to receive the discount. For more information, see the Azusa Light & Water Schedule EV website. Plug-In Electric Vehicle (PEV) Charging Rate Reduction - Burbank Water and Power (BWP) BWP offers a discounted rate to residential or multi-family customers for electricity used to charge PEVs. Customers must remain on the PEV time-of-use rate for a minimum of one year. For more information, see the BWP Electric Vehicles website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Colorado | |||||||||||||

Gunnison County Electric Association (GCEA) EVSE Rebate provides rebates to residential customers toward the purchase of Level 2 EVSE. Eligible customers who purchase and install EVSE can receive a rebate of 35% of the cost of their station (up to $250). Plug-In Electric Vehicle (PEV) Tax Credit Qualified all-electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs), titled and registered in Colorado are eligible for a tax credit. Light-duty PEVs purchased, leased, or converted between January 1, 2017, and January 1, 2022, are eligible for a tax credit equal to the amounts below: Light-duty EV or PHEV $5,000 for purchase or conversion; $2,500 for lease $4,000 for purchase or conversion; $2,000 for lease $2,500 for purchase or conversion; $1,500 for lease Light-duty electric truck $7,000 for purchase or conversion; $3,500 for lease $5,500 for purchase or conversion; $2,750 for lease $3,500 for purchase or conversion; $1,750 for lease Medium-duty electric truck $10,000 for purchase or conversion; $5,000 for lease $8,000 for purchase or conversion; $4,000 for lease $5,000 for purchase or conversion; $2,500 for lease Heavy-duty electric truck $20,000 for purchase or conversion; $10,000 for lease $16,000 for purchase or conversion; $8,000 for lease $10,000 for purchase or conversion; $5,000 for lease The credit amount for any qualifying truck is limited to the difference in manufacturer's suggested retail price between the qualifying truck and a comparable truck that operates on either gasoline or diesel fuel. The credit claimed for converting a truck to a qualifying truck is limited to the cost of conversion. Eligible purchased vehicles must be new, and eligible leased vehicles must have a lease with a term of not less than two years. A purchaser may assign the tax credit generated through the purchase, lease, or conversion to any of the above categories of vehicle to the financing entity, allowing the purchaser to realize the value of the tax credit at the time of purchase, lease, or conversion. The financing entity may collect an administrative fee of no more than $150. For more information, see the Colorado Department of Revenue's Income 69 FYI publication. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Connecticut | |||||||||||||

Plug-In Electric Vehicle (PEV) and EVSE Rebates - Groton Utilities Groton Utilities offers a limited number of $2,000 rebates for the purchase of a new PEV and $1,000 rebates for the lease of a new PEV. Customers may also be eligible for a $600 rebate for the installation of a qualifying Level 2 electric vehicle supply equipment (EVSE). For more information, including how to apply, see the Groton Utilities Electric Vehicle Rebate Program website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: District of Columbia | |||||||||||||

PEPCO Residential Time of Use Rate - Electric Vehicle Program - DC If you are a Pepco residential customer and drive an electric vehicle, you may be eligible for our whole house time of use rate. By shifting your home’s energy usage (including EV charging) to off-peak hours, you can take advantage of lower rates and save on your electricity bill. You can also choose to receive your energy from 100% renewable sources. For more information, see the PEPCO - DC website. Alternative Fuel Vehicle (AFV) Conversion and Infrastructure Tax Credit Businesses and individuals are eligible for an income tax credit of 50% of the equipment and labor costs for the conversion of qualified AFVs, up to $19,000 per vehicle. A tax credit is also available for 50% of the equipment and labor costs for the purchase and installation of alternative fuel infrastructure on qualified AFV fueling property. The maximum credit is $1,000 per residential electric vehicle charging station, and $10,000 per publicly accessible AFV fueling station. Qualified alternative fuels include, ethanol blends of at least 85%, natural gas, propane, biodiesel, electricity, and hydrogen. This incentive expires December 31, 2026. For more information, see the Office of Tax and Revenue website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Florida | |||||||||||||

ChargeUP! Sarasota County offers rebates to businesses, non-profits, and local governments within Sarasota County for the installation of qualified Level 2 or DC fast charging EVSE. Businesses are eligible for a rebate of 25% of the cost of EVSE purchase and installation, up to $2,000, and non-profits or government organizations are eligible for a rebate of 50% of the cost of EVSE purchase and installation, up to $4,000. Plug-in Electric Vehicle (PEV) Rebate - JEA Jacksonville Electric Authority (JEA) offers rebates for new PEVs purchased or leased on or after September 18, 2014. PEVs with a battery less than 15 kilowatt-hours (kWh) in capacity receive $500, and PEVs with larger battery capacity are eligible for $1,000. A copy of a valid Florida vehicle registration, proof of sale, and a recent JEA Electric bill are required. For more information, see JEA's Electric Vehicle Incentives page. Plug-In Electric Vehicle (PEV) Rebate - OUC Orlando Utilities Commission (OUC) provides rebates of $200 to residential customers who purchase or lease an eligible new or preowned PEV. Applicants must apply within six months of the purchase or lease of the PEV. For more information, see the OUC Electric Vehicles at Home page. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Georgia | |||||||||||||

HOV Lane Access: Alternative Fuel vehicles properly licensed with an AF license plate may use HOV lanes. Plug-In Electric Vehicle Charging Rate Incentive - Georgia Power Georgia Power offers a PEV time-of-use electricity rate for residential customers who own a PEV. The PEV rate is optional and does not require a separate meter. For more information, see the Georgia Power Electric Vehicles website. Electric Vehicle Supply Equipment (EVSE) Rebate - Georgia Power Georgia Power offers a rebate to residential customers, businesses, and builders who install Level 2 EVSE. Customers are eligible for a $250, $500, and $100 rebate, respectively, for each dedicated circuit installed through December 31, 2019. Other conditions may apply. For more information, see the Georgia Power Electric Vehicles and Electric Vehicles & Your Business websites. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Hawaii | |||||||||||||

Hawaii Energy and the Ulupono Initiative are giving $5,000 towards the installation of a dual-port, networked, level 2 charging station (up to 4 stations per site). Approved locations can be either public or private, but must service more than one electric vehicle. No private residences. Free Public Parking: State law may exempt vehicles with an EV license plate from parking meter fees at state and county facilities. HOV Lane Access: State law allows vehicles with an EV license plate to access HOV lanes. Plug-In Electric Vehicle (PEV) Charging Rate Incentive - Hawaiian Electric Company Hawaiian Electric Company and its subsidiaries, Maui Electric Company and Hawaii Electric Light Company, offer time-of-use rates for commercial customers with electric vehicle supply equipment. The pilot rates are available to customers on Oahu, in Maui County, and on the Island of Hawaii. For more information, see the Hawaiian Electric Company EVs website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Idaho | |||||||||||||

YTCC offers a rebate of $5,000 toward the purchase of publicly accessible EVSE. Eligible entities include businesses and municipalities in the communities surrounding Grand Teton National Park and Yellowstone National Park. Rebates are offered on a first-come, first-served basis. For more information, see the YTCC Vehicle and Infrastructure Rebates website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Illinois | |||||||||||||

Illinois Electric Cooperative (Co-op) members are eligible for loan financing at 0.5% for 60 months for the purchase of new PEVs. Members must apply and be approved for financing before purchase. The Co-op also offers a PEV time-of-use electricity rate for residential customers who own a PEV. The PEV rate is optional and requires installation of a separate meter. For more information, see the Illinois Electric Cooperative website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Indiana | |||||||||||||

The Indianapolis Power & Light Co (IPL) offers special PEV charging rates, including year-round time-of-use based options, for residential and fleet customers who own a licensed PEV. Customers who are considering purchasing Level 2 electric vehicle supply equipment should contact IPL to discuss the benefits and requirements of participating in the program. Restrictions apply. For more information, see the IPL Electric Vehicle Charging website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Iowa | |||||||||||||

Residential and business CFU customers who own or lease a qualified electric vehicle are eligible for a $50 electric vehicle (EV) community incentive. Iowa customer of MidAmerican Energy are eligible for a $500 rebate when they purchase a qualifying electric vehicle between March 8, 2019 and December 31, 2019. Residential Electric Vehicle Supply Equipment (EVSE) Rebate - Alliant Energy Alliant Energy offers a $250 rebate to residential customers who purchase and install Level 2 EVSE. The EVSE must be purchased and installed between January 1, 2018, and December 31, 2018. For more information, including how to apply, see the Alliant Energy Electric Vehicle Chargers website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Kansas | |||||||||||||

KCPL and Westar customers up to $1,000 off a 2019 Chevrolet Bolt. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Louisiana | |||||||||||||

Tax Credit: The Alternative Fuel Vehicle (AFV) Tax Credit can be applied to 10% of your vehicle purchase cost, or $2,500, whichever is less. This tax credit is available until January 1, 2022. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Maryland | |||||||||||||

Pepco - Maryland: Residential Charger & Property Incentives If you are a Pepco residential customer, live in a single-family house, and install a Level 2 smart charger at your home, you may be eligible for a $300 rebate. Also, if you are a multifamily property manager, owner, or homeowners association, you may be eligible for a 50% discount on the purchase of qualified Level 2 smart chargers and for a 100% discount up to $7,500 on installation at your property. For more information, refer to the Pepco Maryland website to apply. HOV Lane Access: State law allows plug-in electric vehicles to access HOV lanes with a permit valid through September 30, 2022. Tax Credit: The State of Maryland provides $100 per kWh of battery capacity, up to $3,000 maximum per credit, starting July 1, 2017. Credit applied against the excise tax imposed. Eligible vehicles must meet 5kWh capacity minimum. MSRP cap of $63,000 for eligibility. Plug-In Electric Vehicle (PEV) and Fuel Cell Electric Vehicle (FCEV) Tax Credit Qualified PEV and FCEV purchasers may apply for a tax credit against the imposed excise tax, up to $3,000. The tax credit is first-come, first-served, and is limited to one vehicle per individual and 10 vehicles per business entity. Vehicles must be registered in Maryland, unless the vehicle manufacturer conforms to applicable state or federal laws or regulations governing PEVs or FCEVs during the year in which the vehicle was purchased, or the vehicle was originally registered in another state. A qualified vehicle must meet the following criteria: Have a total purchase price not exceeding $63,000; Be propelled to a significant extent by an electric motor that draws electricity from a battery with a capacity of at least five kilowatt-hours; Have not been modified from original manufacturer specifications; and Be purchased and titled for the first time between July 1, 2017, and July 1, 2020. The credit is returned to the taxpayer in the form of a check from the state. Applications have exceeded the 2019 Fiscal Year program funding, but will still be accepted and placed on a waitlist (verified April 2019). For more information, including the request form, see the Maryland Department of Transportation Motor Vehicle Administration's Excise Tax Credit for PEVs website. Electric Vehicle Supply Equipment (EVSE) Rebate Program The Maryland Energy Administration (MEA) offers a rebate to an individual, business, or state or local government entity for the costs of acquiring and installing qualified EVSE. Between July 1, 2017, and June 30, 2020, rebates for 40% of the costs of acquiring and installing qualified EVSE, or up to the following amounts: Individual: $700 Business or State or Local Government: $4,000 Retail Service Station Dealer: $5,000 Applicants must demonstrate compliance with state, local, and/or federal law that applies to the installation or operation of qualified EVSE. Other requirements may apply. Total funding for each fiscal year will not exceed $1,200,000. Applications have exceeded the program funding, but will still be accepted and placed on a waitlist (verified April 2019). For more information, see MEA's EVSE Rebate Program page. Alternative Fuel Vehicle (AFV) Voucher Program The Maryland Energy Administration (MEA) administers the Maryland Freedom Fleet Voucher (FFV) Program, which provides vouchers for the purchase of new and converted AFVs registered in Maryland. Eligible vehicles include purchased or leased light-, medium-, and heavy-duty dedicated natural gas, propane, hybrid electric, plug-in electric, and hydraulic hybrid vehicles. Vehicles must be used by commercial, non-profit, or public entities. Voucher amounts are based on gross vehicle weight rating and are capped at 50% of the vehicle's incremental cost; the cap does not apply to plug-in electric vehicles. Funds are not guaranteed until voucher agreements are fully executed. Applications are currently not being accepted (verified April 2019). For more information, including application requirements, see the Maryland FFV Program website. Plug-In Electric Vehicle (PEV) Charging Rate - BGE Baltimore Gas and Electric Company (BGE) offers a time-of-use (TOU) rate for BGE residential customers who purchase or lease a PEV. The TOU rate, Schedule EV, applies to the energy used for the entire residence during a billing period. Participation requires a meter capable of measuring TOU data. For more information, see Schedule EV. Plug-In Electric Vehicle (PEV) Charging Rate Incentive - Pepco Pepco offers a time-of-use rate to all qualified Pepco residential customers in Maryland who own or lease a PEV. For more information, see Pepco's Plug-In Electric Vehicle Charging website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Massachusetts | |||||||||||||

The Direct Current Fast Charging Program (DCFC) is a competitive grant with an application deadline of March 19, 2021. This program is open to property owners or managers of non-residential locations that are accessible for use by the general public 24 hours per day, or to educational campuses with at least 15 students on site and available to all students and staff. The program provides hardware and installation costs (up to $50,000 per charging station) as follows: • 100% for publicly-accessible stations on government-owned property, • 80% for publicly-accessible stations on non-government-owned property, and • 60% for educational campuses. Workplace & Fleets Charging Program (WPF) is an open enrollment grant that provides up to 60% of hardware and installation costs of a Level 1 (120 volt) or Level 2 (240 volt) EV charging station, up to $50,000 per address. This program is open to employers with 15 or more employees in a non-residential place of business, and to fleet applicants garaging electric vehicles in a non-residential location. • Improvements over the prior Workplace Charging (WPC) and Fleets programs include allowing private and non-profit fleet owners to apply, adding Level 1 stations as eligible equipment for fleets and adding coverage of installation costs for workplaces. Note that the Fleets program under which public entities could previously acquire EVs and charging infrastructure is now for EV acquisition only: public and private entities seeking charging stations for vehicle fleets should apply to the new WPF program. Multi-Unit Dwelling & Educational Campus Charging Program (MUDC) is an open enrollment grant that provides up to 60% of hardware and installation costs of a Level 1 (120 volt) or Level 2 (240 volt) EV charging station, up to $50,000 per address. This program is open to buildings with five or more residential units, or to educational campuses with at least 15 students on site. • Improvements over the prior MUD program include reducing the minimum number of residential units from 10 to 5, allowing educational campuses to apply and adding coverage of installation costs. Public Access Charging Program (PAC) is an open enrollment grant that provides up to 100% for stations on government-owned property, and up to 80% for other locations, of the hardware and installation costs of a Level 1 (120 volt) or Level 2 (240 volt) EV charging station, up to $50,000 per address. This program is open to property owners or managers for locations that are accessible for use by the general public a minimum of 12 hours per day. • Improvements over the prior PAC program include accepting applications on a rolling basis and adding Level 1 stations as eligible equipment. The Massachusetts Department of Energy Resources' Clean Vehicle Project offers grant funding for public and private fleets to purchase alternative fuel vehicles and infrastructure, as well as idle reduction technology. Eligible vehicles include those fueled by natural gas, propane, and electricity, including hybrid electric, solar electric, and hydraulic hybrid vehicles. The Massachusetts Electric Vehicle Incentive Program (MassEVIP) provides grants for 50% of the cost of Level 1 or Level 2 workplace EVSE — up to $25,000. Eligible applicants include employers with 15 or more employees in a non-residential place of business. The Massachusetts Electric Vehicle Incentive Program (MassEVIP) provides grants for the purchase or lease of qualified plug-in electric vehicles (PEVs), zero emission electric motorcycles (ZEMs), and Level 2 EVSE. Grants are available for up to $7,500 for the purchase or lease of a PEV, up to $750 for the purchase or lease of a ZEM and up to $13,500 for the purchase or lease of Level 2 EVSE. Home Energy Loss Prevention Services (HELPS), from the Massachusetts Municipal Wholesale Electric Company, provides residential customers of participating Massachusetts municipal light plants (MLPs) with free or discounted Level 2 EVSE through the program. Plug-In and Zero Emission Vehicle Rebates Massachusetts Department of Energy Resources' Massachusetts Offers Rebates for Electric Vehicles (MOR-EV) Program offers rebates of up to $2,500 through December 31, 2018, to customers purchasing or leasing a plug-in electric vehicle or zero emission motorcycle. Beginning January 1, 2019, MOR-EV will offer rebates of up to $1,500 toward the purchase or lease of eligible battery electric and fuel cell electric vehicles. Rebates are available to Massachusetts residents and residents must submit applications within three months of the vehicle purchase or lease date. Applicants must retain ownership of the vehicle for a minimum of 36 months. For more information, including application and eligibility requirements, visit the MOR-EV website. Plug-In Electric Vehicle (PEV) Discounts - Mass Energy Mass Energy's Drive Green with Mass Energy program provides discounts on qualified PEVs purchased or leased from participating dealerships. The discount program is available to all consumers, including those that are not in Mass Energy's service territory. For more information, including participating dealerships and the discounts they offer, see the Drive Green with Mass Energy website. Electric Vehicle Supply Equipment (EVSE) Discount - Braintree Electric Light Department (BELD) BELD offers customers a discount of $250 for the purchase of a qualified Level 2 EVSE. To qualify, customers must enroll in the Smart Charging Program. For more information, including eligible EVSE criteria, see the BELD Charging Incentives website. Plug-In Electric Vehicle (PEV) Charging Incentive - Braintree Electric Light Department (BELD) BELD’s Smart Charging Program offers a bill credit of $8 per month to customers that charge their PEVs between 9pm and 12pm the next day on weekdays or at any time during the weekend. For more information, see the BELD Charging Incentives website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Michigan | |||||||||||||

DTE Energy offers two rate options to qualified residential customers for charging PEVs. The PEV time-of-use rate is available to customers using Level 2 electric vehicle supply equipment and requires a separate meter, which DTE provides. The flat rate option is $46.28 per month for each PEV. For rate information, including how to qualify, see the DTE Energy PEV Rates website. Consumers Energy offers a special time-of-use rate option for PEV owners. For more information, see the Consumers Energy PEV Rate Options website. Indiana Michigan Power offers a special time-of-use rate option to residential customers who own a qualified PEV. Indiana Michigan Power also provides rebates of up to $2,500 to residential customers who purchase or lease a new PEV and install a Level 2 EVSE with a separate meter. Customers must also sign up for the Indiana Michigan Power PEV time-of-use rate. The rebate is available to the first 250 qualified customers who submit a completed application. For more information, see the Indiana Michigan Power Rates, Programs & Incentives website. The Lansing Board of Water & Light (BWL) offers a pilot PEV time-of-use charging rate to single- or multi-family dwellings of four units or less with separately metered Level 2 electric vehicle supply equipment (EVSE). Additional terms and conditions apply. BWL also offers a reimbursement of up to $1,000 for the purchase and installation of EVSE for customers that have enrolled in the PEV charging rate. The program is limited to the first 10 qualified residential customers, and the deadline to apply is June 30, 2018. For more information, see the BWL PEVs website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Minnesota | |||||||||||||

Dakota Electric members enrolled in the ChargeWise program receive a reduced rate for the electricity used to charge PEVs between specified off-peak hours. Installation of a ChargeWise circuit is required. Dakota Electric also offers a rebate of up to $500 for the installation of Level 1 or Level 2 electric vehicle supply equipment (EVSE). For more information, visit the Dakota Electric ChargeWise website. Connexus Energy offers reduced electric rates to residential customers in their service territory who charge PEVs. To participate, customers may contact their own electrician or Connexus Energy's electrician to install the metering equipment. The meter must be permitted and inspected. For more information, see Conexus Energy's Electric Vehicle page. Connexus Energy offers a $500 rebate to residential customers towards the installation of a qualified Level 2 EVSE. Eligible applicants must enroll in a time-of-use rate. For more information, see Conexus Energy's Electric Vehicle page. Xcel Energy offers two rate options to qualified residential customers for charging PEVs. The Electric Vehicle (EV) Rate and the Time-of-Day Plan are optional and require a separate meter. For rate information, including how to qualify, see Xcel Energy's Electric Vehicle Rate Options page. Great River Energy's Revolt initiative offers the ability to power a PEV with 100% wind energy for the lifetime of the vehicle. The program requires no additional cost, however standard or off-peak rates still apply for the electricity used. For more information, see Revolt's Wind Energy Promotion page. Lake Region Electric Cooperative (LREC) members enrolled in the ChargeWise program receive a reduced rate for the electricity used to charge PEVs between specified off-peak hours. To be eligible for the reduced rate, vehicles must use a separate sub-metered circuit. LREC also offers a rebate of up to $500 for the installation of Level 1 or Level 2 electric vehicle supply equipment (EVSE). For more information, see the LREC ChargeWise website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Missouri | |||||||||||||

Connexus Energy offers a $500 rebate to residential customers towards the installation of a qualified Level 2 EVSE. Eligible applicants must enroll in a time-of-use rate. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Nebraska | |||||||||||||

Omaha Public Power District (OPPD) offers rebates of $500 to residential customers toward the purchase of qualified Level 2 EVSE. Participants must purchase the EVSE through OPPD, and rebates are available to the first 250 participants. For more information, including how to apply, see the OPPD Electric Vehicle Rebate Pilot Program website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Nevada | |||||||||||||

Nevada Energy (NV Energy) offers discounted electricity rates to residential customers in the northern and southern service territories who charge PEVs during off-peak hours. The discounted rate applies to all electricity use on the premises during off-peak hours. To participate, customers must allow NV Energy access to their electric meters. For more information, see the Electric Vehicle Rate website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: New Hampshire | |||||||||||||

NHEC offers rebates of $1,000 for the purchase or lease of a new or used electric vehicle (EV), and $600 for the purchase or lease of a new or used plug-in hybrid electric vehicle. The PEV must be purchased or leased between January 1, 2018, and December 31, 2018. For more information, including how to apply, see the NHEC Drive Electric website. NHEC offers a residential off-peak rate program for electricity purchased to charge PEVs. The electricity used for vehicle charging is metered separately from all other electricity use. For more information, see the NHEC Drive Electric website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: New Jersey | |||||||||||||

Sales Tax Exemption: A sales tax exemption is available for the purchase or lease of zero emission electric vehicles. HOV Lane Access: Qualified hybrid vehicles can use the HOV lane from Interchange 11 to Interchange 14 during certain times. New Jersey Turnpike Authority's Green Pass Discount Plan provides a 10% discount on off-peak New Jersey Turnpike and Garden State Parkway toll rates for drivers of vehicles that have a fuel economy of 45 miles per gallon or higher and meet the California Super Ultra Low Emission Vehicle standard. Vehicles must register with New Jersey E-ZPass. Drive Green NJ It Pay$ to Plug-In offers $5,000-$6,000 per Level 2 single/dual port EVSE installed. Requirements focus on public parking, workplace, and multi-unit dwelling. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: New York | |||||||||||||

Upstate New York Electric Vehicle Charging Station Make-Ready Program Get ready – electric vehicle adoption is on the rise in New York State. Make sure you can welcome their owners by installing EV charging stations. National Grid can help with significant installation incentives. Adding EV charging stations is a great way to attract and retain new customers, tenants, and employees to your destination, while helping New York reduce its greenhouse gas emissions. Learn more here.

HOV Lane Access: New York’s Clean Pass Program allows eligible low-emission, energy-efficient vehicles to use the 40-mile Long Island Espressway High Occupancy Vehicle (LIE/HOV) lanes, regardless of the number of occupants in the vehicle. Motorists whose estimated US EPA fuel economy rating averages at least 45 miles per gallon and meets the California Air Resources Board SULEV emissions standard will be allowed to participate by applying to the State Department of Motor Vehicles. See the Clean Pass Program website for details on how to apply and which vehicles are eligible. The Municipal ZEV Clean Vehicle Rebate Program provides rebates to cities, towns, villages, and counties to purchase or lease new clean vehicles for fleet use. Applications will be accepted on a first come, first served basis until funds are exhausted. Plug-in Electric Vehicle (PEV) Toll Discount Program Vehicles eligible for the New York Clean Pass Program, including PEVs and hybrid electric vehicles, receive a discounted toll rate on all Port Authority of New York & New Jersey (PANYNJ) off-peak hour crossings. Vehicles must register with E-ZPass New York. Drivers of qualified vehicles may also receive a 10% discount on established E-ZPass accounts with proof of registration. This exemption expires September 30, 2019. For more information, including a complete list of eligible vehicles and application instructions, see the PANYNJ E-ZPass and Green Pass Discount Plan websites. Plug-In Electric Vehicle (PEV) Rebate Program The New York State Energy Research and Development Authority (NYSERDA) provides rebates of up to $2,000 for the purchase or lease of a new eligible PEV. An eligible vehicle must:

Rebate amounts vary based on a vehicle's all-electric range and manufacturer's suggested retail price. For more information, see NYSERDA's Drive Clean Rebate website. Workplace Electric Vehicle Supply Equipment (EVSE) and Plug-In Electric Vehicle (PEV) Incentives The New York State Energy Research and Development Authority is offering employers in the greater New York City region $8,000 rebate per dual-connector EVSE installed. Employees of organizations that receive the rebate are eligible for a $500 rebate toward the purchase or lease of a qualified PEV. For more information, see the Charge to Work NY website. Plug-In Electric Vehicle (PEV) Voluntary Time of Use (TOU) Rate Price Guarantee - Con Edison Under the voluntary TOU rate, residential customers will pay a reduced price for electricity used during the designated off-peak period. Customers who register a PEV with Con Edison and are participating in the voluntary TOU rate are guaranteed to pay no more than the standard electric rate for one year after registration with Con Edison. For more information, including how to enroll, see the Electric Vehicles & Your Bill website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: North Carolina | |||||||||||||

VW Settlement Level 2 Charge Rebate Program Approximately $1.15 million will be available in Phase 1 for the Zero Emission Vehicle Level 2 Charging Infrastructure Rebate Program. This program is designed to expand the state's ZEV charging infrastructure network. This is a first-come first-served rebate program and will be open until all funds are exhausted. An application must be submitted to NCDEQ and approved for a rebate voucher prior to purchase and installation of the Level 2 charging equipment to qualify. Rebate voucher recipients must provide their own funding to cover expenses as they are incurred and submit proof that the project invoices have been paid, proof of project work completion, and other additional required documentation to NCDEQ. Rebate redemption requests for unpaid invoices will not be approved. Visit the North Carolina Department of Environmental Quality website for more information on how to apply and roll-out timeline. EVSE Rebate and Charging Rate Reduction - Randolph Electric Membership Corporation (EMC) Randolph EMC's Electric Vehicle Utility Program (REVUP) offers rebates for residential customers of $500 towards the purchase of residential Level 2 electric vehicle supply equipment (EVSE). To qualify, residents must be a registered owner of an electric vehicle (EV), purchase and install a Wi-Fi connected Level 2 EVSE, and agree to share the data collected by the EVSE. Rebates are available to the first 25 applicants. REVUP also offers residents an EV time-of-use (TOU) rate. For more information, see the REVUP website. Electric Vehicle Supply Equipment (EVSE) Rebate – Cape Hatteras Electric Cooperative (CHEC) Cape Hatteras Electric Co-Op (CHEC) offers a bill credit of $100 to residential customers who install a Level 2 EVSE. For more information, including how to apply, see the CHEC Electric Vehicles website. Plug-In Electric Vehicle (PEV) Charging Rate Incentive – Cape Hatteras Electric Cooperative (CHEC) Cape Hatteras Electric Co-Op (CHEC) offers time-of-use (TOU) electricity rates to residential customers with a PEV. For more information, see the CHEC Electric Vehicles website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Ohio | |||||||||||||

AEP Ohio is offering rebates for 300 Level 2 ports for public, workplace, and multifamily properties as well as 75 public DC fast charging stations. The Level 2 rebates cover between 50% and 100% of the combined charging station plus make-ready costs with caps ranging from $5K to $10K per port. The DC fast charging rebates cover 80% (capped at $50K) or 100% (up to $100K) of the total charging station plus make-ready costs for privately-owned or government-owned property. Properties in low income geographic areas are encouraged to apply, at least 10% of funding will be set aside for these areas and covered 100% in cost. Find out more information on the AEP EV Charging website. Smart Columbus Electrification Program (SCEP) Multi-Unit Dwelling (MUD) Incentive Program offers incentives of up to $25,000 per multi-unit dwelling property or facility, but cannot exceed $3,500 per installed plug or parking space. Applicants must provide a 35% of total project cost cash match requirement. Eligible costs include purchase and installation of charging stations. Find more information from the Smart Columbus MUD Incentive Program Application page. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Oklahoma | |||||||||||||

The Alternative Fueling Infrastructure Tax Credit is a one-time income tax credit available through January 1, 2020 to corporations for up to 75% of the cost of an electric vehicle charging station project. Tax credits can be claimed on multiple properties although some restrictions apply. Find more information on the Oklahoma State Courts Network website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Oregon | |||||||||||||

The Clean Vehicle Rebate Program provides rebates to Oregon residents, businesses, non-profit organizations, and government agencies for the purchase or lease of PEVs. New PEVs with a battery capacity of less than 10 kilowatt-hours (kWh) are eligible for a rebate of $1,500 and new PEVs with a battery capacity greater than 10 kWh are eligible for a rebate of $2,500. Oregon residents that meet low or moderate household income requirements are eligible for rebates of $2,500 for the purchase or lease of used all-electric vehicles (EVs) and $5,000 for the purchase or lease of new EVs. For more information, see the Clean Vehicle Rebate Program website. Residential EWEB customers who purchase a qualified PEV are eligible for a $300 rebate to use toward electricity costs or to help offset the cost of a residential electric vehicle charging station. For more information, including how to apply, see EWEB’s Electric Vehicles website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Pennsylvania | |||||||||||||

PA DEP “Driving PA Forward” is a $7.7M dollar fund which offers $4,000-$5,000 per Level 2 EVSE installed. Requirements focus on public parking, workplace, and multi-unit dwelling. Alternative Fuel Vehicle (AFV) Rebate The AFV Program offers rebates to assist eligible residents with the incremental cost of the purchase or lease of new AFVs, including all-electric vehicles (EVs), plug-in hybrid electric vehicles (PHEVs), hydrogen fuel cell electric vehicles (FCEVs), natural gas vehicles (NGVs), and propane vehicles. Eligible vehicles must have a total purchase price not exceeding $60,000. Rebates are available in the following amounts: Rebate Amount Vehicle Type: EV, PHEV, electric motorcycle, and low-speed EV Requirement: Battery capacity greater than or equal to 85 kilowatt hours (kWh) Rebate Amount: $2,000 EV Requirement: Battery capacity less than 85 kWh and equal to or greater than 30kWh Rebate Amount: $1,750 EV Requirement: Battery capacity greater than or equal to 10kWh and less than 30kWh Rebate Amount: $1,000 Vehicle Type: FCEV EV Requirement: Original equipment manufacturer (OEM) or certified retrofit Rebate Amount: $2,000 Vehicle Type: Natural gas and propane EV Requirement: OEM or certified retrofit Rebate Amount: $2,000 Vehicle Type: One-time preowned AFV EV Requirement: 75,000 miles or less Rebate Amount: $750 An additional rebate of $500 is available for all vehicles if an applicant meets the low-income requirement, as defined by the U.S. Department of Health and Human Services. Rebates are awarded on a first-come, first-served basis. For more information, including forms and detailed requirements and restrictions, see the AFV Rebates website. Plug-In Electric Vehicle (PEV) Rebate - PECO PECO provides rebates of $50 to residential customers who purchase a new, qualified PEV. For more information, see the PECO Driver Rebate website. Plug-In Electric Vehicle (PEV) Credit – Duquesne Light Company (DLC) DLC offers a one-time bill credit of $60 to residential customers who purchase or lease a PEV. For more information, including how to apply, see the DLC Electric Vehicles website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Rhode Island | |||||||||||||

The Rhode Island Office of Energy Resources (OER) DRIVE program offers up to $2,500, based upon vehicle battery capacity, to qualified Rhode Island residents interested in purchasing or leasing an EV. The purchase or lease must be executed on or after the program start date of January 29, 2016. Alternative Fuel Vehicle (AFV) Tax Exemption - Warren The town of Warren may allow excise tax exemptions of up to $100 for qualified AFVs registered in Warren. Qualified vehicles must be primarily fueled with one of the following: an electric motor drawing current from rechargeable batteries or fuel cells; gas produced from biomass, where biomass is defined as any organic material other than oil, natural gas, and coal; liquid, gaseous or solid synthetic fuels produced from coal; or coke or coke gas. (Reference Rhode Island General Laws 44-34-14) Electric Vehicle Supply Equipment (EVSE) and Plug-In Electric Vehicle (PEV) Rebates The Charge Up! program provides rebates to state and municipal agencies for the purchase and installation of publicly accessible Level 2 or DC fast chargers. Agencies are eligible for up to $60,000 in incentives for EVSE that are installed and operational on or after July 1, 2016. Agencies that install EVSE also qualify for up to $15,000 to support the purchase or lease of a new PEV acquired on or after July 1, 2016, as part of their public sector fleet. For more information, see the Rhode Island Office of Energy Resources Charge Up! website. Plug-In Electric Vehicle (PEV) Discounts - People's Power & Light (PP&L) PP&L's Drive Green with PP&L program provides discounts on qualified PEVs purchased or leased from participating dealerships. The discount program is available to all consumers, including those that are not in PP&L's service territory. For more information, including participating dealerships and the discounts they offer, see the Drive Green with PP&L website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Tennessee | |||||||||||||

HOV Lane Access: Hybrid vehicles with a Smart Pass sticker may use HOV lanes. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Texas | |||||||||||||

Denton Municipal Electric (DME) is offering a rebate of $300 for the purchase of an electric vehicle. Rebate applicants must agree to charge during the off-peak hours of 10pm to 7am. Registration address must be within DME service territory and served by DME. Clean Vehicle Replacement Vouchers The Texas Commission on Environmental Quality administers the AirCheckTexas Drive a Clean Machine program, which provides vehicle replacement assistance for qualified individuals owning vehicles registered in participating counties. Vouchers in the amount of $3,500 are available toward the purchase of a hybrid electric, battery electric, or natural gas vehicle that is up to three model years old. For more information about participating counties, qualified vehicles, program requirements, and how to apply in specific areas, see the AirCheckTexas Drive a Clean Machine website. Light-Duty Alternative Fuel Vehicle Rebates The Texas Commission on Environmental Quality (TCEQ) administers the Light-Duty Motor Vehicle Purchase or Lease Incentive Program for the purchase or lease of a new light-duty vehicle powered by compressed natural gas (CNG), propane, hydrogen, or electricity. CNG and propane vehicles, including bi-fuel vehicles, are eligible for a rebate of $5,000 for the first 1,000 applicants. Electric drive vehicles powered by a battery or hydrogen fuel cell, including plug-in hybrid electric vehicles with a battery capacity of at least 4 kilowatt hours, are eligible for a rebate of $2,500, for the first 2,000 applicants. One rebate is available per eligible vehicle. Applications must be submitted by May 31, 2019. For more information, including eligibility requirements and the application form, see the TCEQ Texas Emissions Reduction Plan website. Electric Vehicle Supply Equipment (EVSE) Incentive - Austin Energy Plug-in electric vehicle owners in the Austin Energy service area may be eligible for a rebate of 50% of the cost to purchase and install a qualified Level 2 EVSE, up to $1,200. For additional information, see the Austin Energy Home Charging website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Utah | |||||||||||||

Qualified taxpayers are eligible for a tax credit for the purchase of a qualified heavy-duty AFV. Qualifying fuels include natural gas, electricity, and hydrogen. Each qualified heavy-duty AFV is eligible for the following tax credit amounts: Year: 2019 Credit Amount: $18,000 Year: 2020 Credit Amount: $15,000 At least 50% of the qualified vehicle's miles must be driven in the state. A single taxpayer may claim credits for up to 10 AFVs or $500,000 annually. If more than 30% of the total available tax credits in a single year have not been claimed by May 1, a taxpayer may apply for credits for an additional eight AFVs. Up to 25% of the tax credits are reserved for taxpayers with small fleets of less than 40 vehicles. This credit expires December 31, 2020. Additional conditions and restrictions may apply. (Reference Utah Code 59-7-618, 59-10-1033, and 59-13-201) Rocky Mountain Power offers residential customers with PEVs $200 to enroll in a time-of-use (TOU) rate pilot. Participants may choose between two rate plans. The TOU rate will apply to all household energy use. For more information, see the Rocky Mountain Power PEV TOU Rate Pilot Program website. Rocky Mountain Power provides rebates to non-residential and multi-family customers toward the purchase of Level 2 and direct current (DC) fast EVSE. Customers installing Level 2 EVSE may receive a rebate of 75% of equipment cost, up to $2,500 for single port stations and $3,500 for multi-port stations. Customers installing DC fast charging EVSE may receive a rebate of 75% of equipment and installation cost, up to $30,000 for single port stations and $42,000 for multi-port stations. To receive a rebate, customers installing Level 2 EVSE must submit an application within 90 days of the station installation; customers installing DC fast charging EVSE must submit an application for utility approval before purchasing and installing equipment. Customers may also complete an application for a custom grant project; applications must be submitted by April 1, 2019. Rebates and grant funding is available on a first-come, first-served basis. For more information, see the Rocky Mountain Power Utah Electric Vehicle Incentives website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Vermont | |||||||||||||

Washington Electric Coop is offering an incentive of $1,900 towards the purchase or lease of a battery electric vehicle or $950 towards a plug-in hybrid. Vermont Electric Coop is offering bill credits up to $500 one time for the purchase, or up to $100/year for the lease of an EV. Stowe Electric Department is offering customers an $850 incentive for the purchase of a new all-electric vehicle or $450 for a plug-in hybrid vehicle. Income qualifying customers will also be eligible for an additional $250 incentive. Plug-In Electric Vehicle Rebate - Burlington Electric Department (BED) BED customers are eligible for a $1,200 rebate on the purchase or lease of a new qualifying all-electric vehicle (EV). Qualifying plug-in hybrid electric vehicles (PHEVs) are eligible for a $1,000 rebate. Moderate income customers are eligible for an additional $600 rebate for an EV or an additional $500 rebate for a PHEV. Vehicles must have a manufacturer's suggested retail price (MSRP) of less than $50,000 and be registered in Burlington, VT. Rebates are available through December 31, 2019. For more information, including how to apply, see the BED Electric Vehicles website. Electric Vehicle Supply Equipment (EVSE) Incentives - Green Mountain Power (GMP) GMP residential customers are eligible for a free Level 2 EVSE when they purchase a new all-electric vehicle (EV). Residential customers that already own an EV may rent a Level 2 EVSE station at a low monthly fee. In addition, customers may enroll in GMP's EV Unlimited Plan for unlimited EV charging during off-peak hours at a flat monthly fee. For more information about these incentives, see GMP's In-Home Level 2 EV Charger website. Plug-In Electric Vehicle (PEV) Charging Rate Reduction and EVSE Rebate - BED Burlington Electric Department (BED) offers a per kilowatt-hour discount for residential customers to charge PEVs during off-peak times. To qualify, customers must install a WiFi enabled electric vehicle supply equipment (EVSE). BED also offers a rebate of $400 for the purchase and installation of a qualifying Wifi enabled EVSE for customers that have enrolled in BED’s Residential EV Rate. Eligible applicants must have purchased EVSE within 60 days of the acquisition of the EV. For more information, see the BED EV Rate website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Virginia | |||||||||||||

HOV Lane Access: Qualified hybrids, PHEVs and EVs may purchase a clean fuel license plate for $25 annually to access HOV lanes. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Washington | |||||||||||||

The Washington State Department of Transportation (WSDOT) has developed a pilot funding program to strengthen and expand the West Coast Electric Highway network by deploying DC fast charging infrastructure along highway corridors in Washington. The first phase of the pilot program is July 1, 2017 through June 30, 2019. The program is not currently accepting applications (verified February 2018). Electric Vehicle Supply Equipment (EVSE) Rebate – Avista Avista offers rebates to residential and workplace customers for the installation of a Level 2 EVSE of up to $1,000 and $2,000, respectively. Rebates are limited to the first 240 residential and 175 workplace customers that apply. For more information, including how to apply, see the Avista Electric Transportation website. |

|||||||||||||

| State Funding, Tax Credits, & Rebates: Wisconsin | |||||||||||||

Alliant Energy offers a $250 rebate to residential customers who purchase and install Level 2 EVSE. The EVSE must be purchased and installed between January 1, 2018, and December 31, 2018. For more information, including how to apply, see the Alliant Energy Electric Vehicle Chargers website. |

|||||||||||||

| State Funding, Tax Credits, Rebates & Incentives: By State | |||||||||||||

| Clean and renewable energy rebates have become available within many states. Click on your state below to find what rebates, tax credits, and incentives are available.

Take a look at our line sheet here. |

|||||||||||||

| Understanding Electric Vehicle Types | |||||||||||||

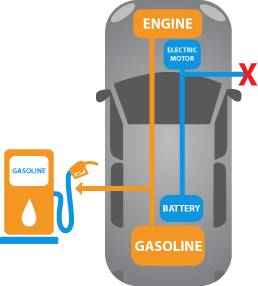

HEVs are powered by an internal combustion engine (gasoline) combined with one or more motors (electric) that draw energy stored from rechargeable batteries.

HEVs cannot plug-in to an external power source to charge the batteries (HEVs aren't typically considered 'electric vehicles'). Instead, they use 'regenerative braking' and the internal combustion engine to recharge. Upon braking, the electric motor acts as a generator, capturing lost energy during braking and storing it in the battery.

Smaller engines are possible due to extra help from the electric motor. The battery also assists in powering auxiliaries such as sound systems/headlights and reducing engine idle when the vehicle is stopped.

HEV examples: Honda Insight, Toyota Prius, Ford Fusion Energi

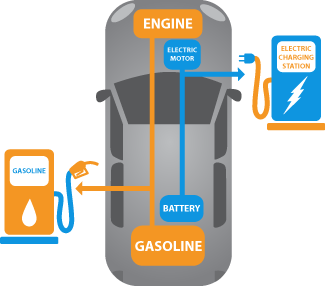

Typically, PHEVs will start-up in electric-mode. Upon battery depletion, the internal combustion engine kicks in, thus operating as a conventional non-plug-in hybrid. Whereas conventional internal combustion vehicles rely entirely on friction to slow, PHEVs 'regenerative braking' uses the electric motor as a generator, capturing some of that lost kinetic energy and storing it in the battery. Since PHEVs can operate on electricity from the grid, these types of EVs offer much-improved environmental performance and significantly reduce the cost of fuel by substituting grid electricity for gasoline. PHEV examples: Chevrolet Volt, Toyota Prius Prime, Mitsubishi Outlander, Kia Niro

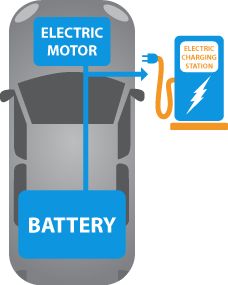

Unlike HEVs and PHEVs that contain an internal combustion engine alongside an electric motor, BEVs (also known as 'all-electric' vehicles) are strictly battery-powered vehicles. The battery is charged by grid electricity (either a wall-socket or designated electric vehicle charging equipment).

Like HEVs and PHEVs, BEVs feature 'regenerative braking' as well as 'idle-off' (turning the car off when stopped).

BEVs have the benefit of home recharging as well as an increase of public and workforce charging stations becoming widely available.

BEV examples: Chevrolet Bolt, Nissan LEAF, Tesla, Volkswagen e-Golf, BMW i3

Besides the benefits of driving an electric vehicle (ultra-low emissions and overall cost-effectiveness to name a few), many states in the US offer incentives to purchase an electric vehicle and/or electric vehicle charging stations and equipment.

To find out if your state offers funding for electric vehicles and charging equipment, please visit this page.

|

|||||||||||||

| How do I contact you? | |||||||||||||

How do I contact you? Please send quote requests and product specification inquiries to: sales@evCHARGEsolutions.com Please send purchase orders to: orders@evCHARGEsolutions.com Please send technical support inquiries to: service@evCHARGEsolutions.com Please send accounts payable & receivable inquiries to: accounting@evCHARGEsolutions.com Monday - Friday 8am - 5pm (EST) Phone: 585-533-4051 |

|||||||||||||